Map by Steve Hyde

Additional research provided by Danny Hackin

by Dominic Corva, Executive Director

*This late-August update uses the 8/19 Washington State Liquor Control Board list of “Marijuana License Applicants.”

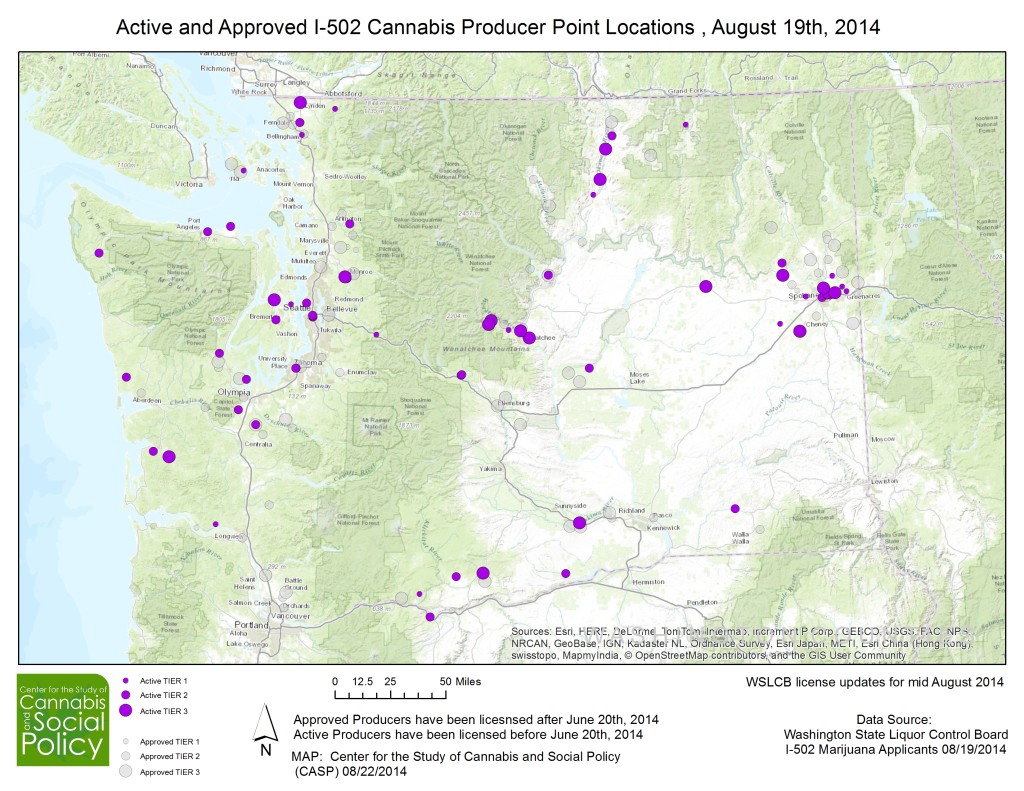

The purpose of this post is to extrapolate from the most current data in order to map the legal cannabis production landscape and identify the scope and rate of active production for the I-502 market. The map above shows you how the landscape is filling in by Tier, and differentiates “Active” from “Approved” producers by allowing for a 10 week lag between approval and approximate expected production. The 10 weeks are a “rule of thumb” estimation rather than derived from any particular assessment for each producer. We’ll start with a table that shows our estimation of Active max square feet of canopy by Tier, next to pending production, approved less than 10 weeks ago, next to the total Approved which should be Active around 10/24/2014.

| Max Sq ft Canopy | Active 8/24 | Approved not Active yet | Total Approved |

| Tier 1 | 23800 | 19600 | 43400 |

| Tier 2 | 259000 | 280000 | 539000 |

| Tier 3 | 378000 | 903000 | 1281000 |

| All Tiers | 660800 | 1202600 | 1863400 |

We have a maximum of 1,863,400 square feet of approved canopy, but only about a third of that should be considered active. This means that in the next two months, we expect active production to increase by about 282% . Most of that will be from Tier 3 producers, of which 18 out of 61 are currently active. The ratio of Tier 1:Tier 2:Tier 3 approval until two months ago was 17:37:18. Since then it is 14:40:43. Either the WSLCB is focusing on Tier 3 approval more or Tier 3’s are finding an easier path to approval for other reasons. The upshot of this is that a LOT more canopy is being approved at a faster rate. We can see this in the following two trend charts, trajectory of approved canopy and trajectory of active canopy.

This time we are pleased to supplement the map with a range of graphs to help policymakers and the public understand the rate of expected canopy activation rather than simply producer activation, and to project currently approved canopy to its expected dates of activation, once again by adding 10 weeks to individual approval dates. Then, we will look at what that means in terms of market share among the Tiers.

*Pardon the charts, I had a problem exporting from googledocs to wordpress so I took screenshots*

The above charts help us understand how the rate of approval is a bit misleading: instead we want to add 2 months to the approval date to get approximate activation dates. We expect the Aggregate Active Max Canopy on October 18th to match up with the Aggregate Approved Max Canopy on August 18th, more or less the latest entry in the WSLCB updates.

The reader can also see that the process is gaining momentum — certainly not a characteristic of a process that is “failing” in any way.What we see above is a logarithmic expansion that really takes off the beginning of June, when the first retail stores opened. This was to be expected, given the WSLCB shifted resources to getting retail off the ground. Now they are turning their limited human resources back to producer/processor approvals, perhaps especially focused on Tier 3s per the reasoning above.

The information provided also gives us a picture of market share by Tier, right now and two months from now.

Tier 3 Canopy is on its way to swallowing up market share, confirming CASP’s earlier statements that now is the best time for smaller producers to position themselves in the market, and to plan for substantial supply increases which will drive wholesale prices down. This is a major reason why current active producers have a slightly different idea of what constitutes fair wholesale market pricing, compared with retailers. One way they are resolving this tension is by establishing long term contracts at below-current market prices.

In the medium term, however, this analysis of production trends should be coupled with an analysis of retail store trends. Wholesale “supply” is a function of retail demand, not consumer demand. Retail demand will be increasing over time, though we are not sure at what rate right now. So increased production won’t necessarily drive prices down — that depends on the rate of increased retail outlets. Currently 46 retailers have been approved, and only some of these are open, and only a handful are able to stay open without running out of product. With over 330 potential retail outlets under the current rules, we can’t confidently estimate when retail prices will come down. We can, however, suggest that supply is increasing at a logarithmic rate; that October is non-indoor harvest time; and that 43 Tier 3’s are ramping up to harvest as we speak.

There is so much more to discover before we can really predict anything sophisticated about prices and supply. My preliminary research suggests that most indoor producers are operating between 30-50% canopy, while greenhouse and full sun are closer in general to their maximum canopy. For now, I would note that non-indoor spatial logic is mostly seasonal, while indoor spatial logic is mostly not.

We also need to know more about cycle variability, especially indoor. Many indoor producers are staggering production so that they harvest more regularly than the 4-5 cycles upon which WSLCB rules are predicated. They are trading flowering canopy space for steady revenue, so that affects how much becomes available for wholesale at any given time.

Finally, we would be remiss not to point out how far ahead Spokane and Okanagon seem to be in terms of approved producers (see intro map above). Part of it might be the afrementioned possible focus on approving Tier 3’s right now, but it also may be the effect of organizing by potential I-502 producers to prepare their jurisdictions for a smoother transition.

We look forward to discovering so much more, and adjusting our analyses accordingly.

One thought to “August I-502 Legal Production Update and Analysis”

Comments are closed.