By Dr. Jim MacRae, CASP Research Associate

As we approach the 8-month anniversary of Washington’s market for State-legal Cannabis, a clear pattern of linear growth is emerging in the level of observed total daily sales. When one considers that, as of Monday Feb 23, 2015, the State-legal Cannabis market in Washington has generated over $100 million in cumulative sales, this growth suggests strong future revenue potential for the State.

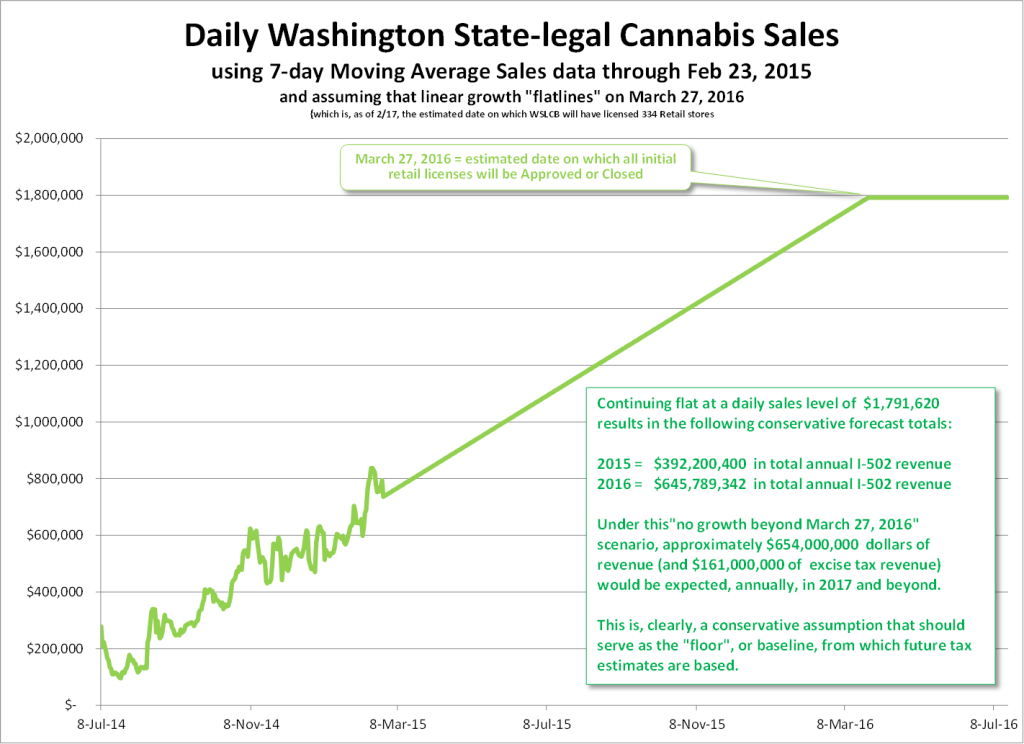

Driven in large part by the steady approval of I-502 licenses and the associated structural growth in the market, the “best-fit” linear trend is currently predicting a daily increase in the level of sales of almost $2,660 (e.g., next Monday is expected to generate $18,600 more than this Monday did).

We assume that one of the primary determinants of the growth rate seen so far in State-legal Cannabis sales is the rate of licensing of new I-502 businesses (primarily Retailers). Under this assumption, current levels of sales growth are expected to increase until approximately March of 2016 (at which time, we estimate that the WSLCB will have largely completed processing the initial batch of I-502 Retail business applications).

Using the conservative assumption that sales will continue to grow at their current rate until March 27, 2016 and then will go flat, we estimate the following annual sales totals for 2015 and 2016:

In 2015, $392,200,400 in total State-legal Cannabis sales are expected (generating $98 million in excise tax revenue).

In 2016, sales of $645,789,342 are expected, (generating over $161 million in excise tax revenue).

For those currently considering legislation that will impact this industry, these estimates would serve well as a “floor” or baseline against which future projections could be compared.

If the punitive 25/25/25 tax burden continues, business failures will tend to decrease revenue (and taxation) expectations.

If local governments are allowed to continue the obstructionist position that many are taking, even more businesses will fail or fail to begin operations and these expectations for revenue (and taxation) will decrease.

If, on the other hand, restrictive regulations, inappropriate geographic restrictions, and obstructionist permitting processes are discouraged, this marketplace will develop and grow. With the institution of a taxation structure that allows at least the possibility of competing with unregulated Cannabis markets, this marketplace could well thrive.

Call your Representatives and/or Senator(s) today and let them know that you want to see this market thrive and that a vote supporting the State-legal Cannabis Industry is a vote against the black market and all of the unregulated behavior, nasty up-selling, and targeting of minors that tend to go along with it.