by Dr. Dominic Corva, Executive Director, and Dr. Jim MacRae, Research Associate

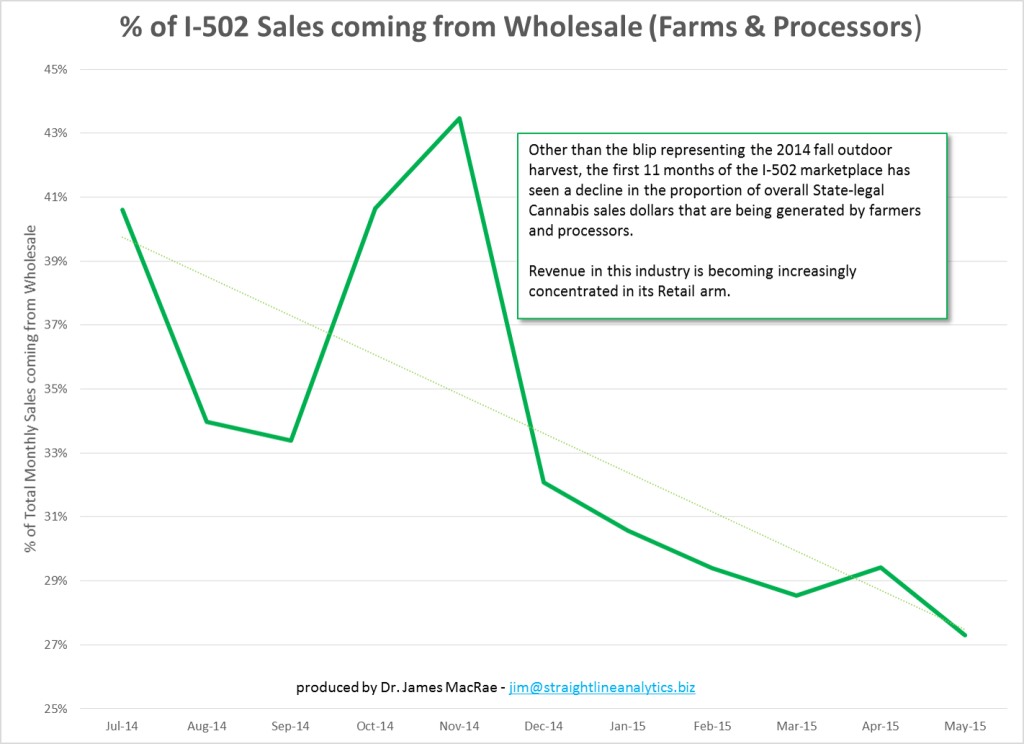

The I 502 cannabis market is just shy of its first birthday, and this chart demonstrates the consolidation of gross revenue at the retail level over the first 11 months. The first three months of the story took place when a few dozen retail stores struggled to stay open and stocked with cannabis. This condition was alleviated considerably as the first light dep crops were harvested and processed through the system: producers and processors continued to command premium wholesale prices through November. But on November 15, 2014, Randy Williams of Fireweed Farms put up his entire outdoor harvest for auction, netting about $2K per pound wholesale, or roughly $4/g.

Wholesale prices plummeted over the next month and have stayed low ever since, although there has clearly been price stabilization starting in February that indicates the fall harvest inventory began clearing. Some of the wholesale price pressure has been alleviated by the opening of new retail stores. At last count, 148 out of 163 approved retailers have reported sales and thus should be considered operational. At the same time, however, indoor production is coming online rapidly: May’s harvest numbers from the WSLCB came in at 6494 lbs. This includes both bud and raw material for processing into extracts and edibles, but note that this figure is about half that of last November when the outdoor harvest sent wholesale prices tumbling to a range of $2-$7/g.

Thus the story of the chart, in which retailers are capturing a larger and larger share of industry sales. On the one hand, this is visual evidence for the logic of collecting I 502 taxes at the point of retail, a legislative I 502 fix that is currently stalled in special session after special session. Until this fix arrives, wholesalers — and to a lesser extent, processors — will be squeezed tighter and tighter between the rock of plentiful supply and the hard place of exorbitant excise taxes. In between, the excruciatingly slow expansion of retail concentrates industry sales revenue at the end of the supply chain.