Since the publication of this post, we have been alerted that our assumption that most active Tier 3 producers are not indoor may be way off. Blaine Stum, a researcher with the Spokane Marijuana Policy Working Group, reports that according to his research so far 7 out of the 8 Tier 3’s approved before May 1 may be indoor. We will adjust our analysis going forward, but keep this in mind for now — Dr. Corva, 7/19/2014

by Dominic Corva, Executive Director

This is the third in CASP’s ongoing analysis of Washington State Active Legal Cannabis supply. Yesterday, we broke down the pace of approval and started to learn something about the pace of legal cannabis production in the context of an imagined social problem produced by I-502 implementation, the “shortage” that many who should know better are citing as evidence of policy failure. We will be tackling the “failure” cry as it pertains to I-502 as social, not just cannabis, policy in the coming week. But for now I want to expand our examination of the I-502 legal cannabis markets as they take shape and how we expect them to change, rather than how they are a failure.

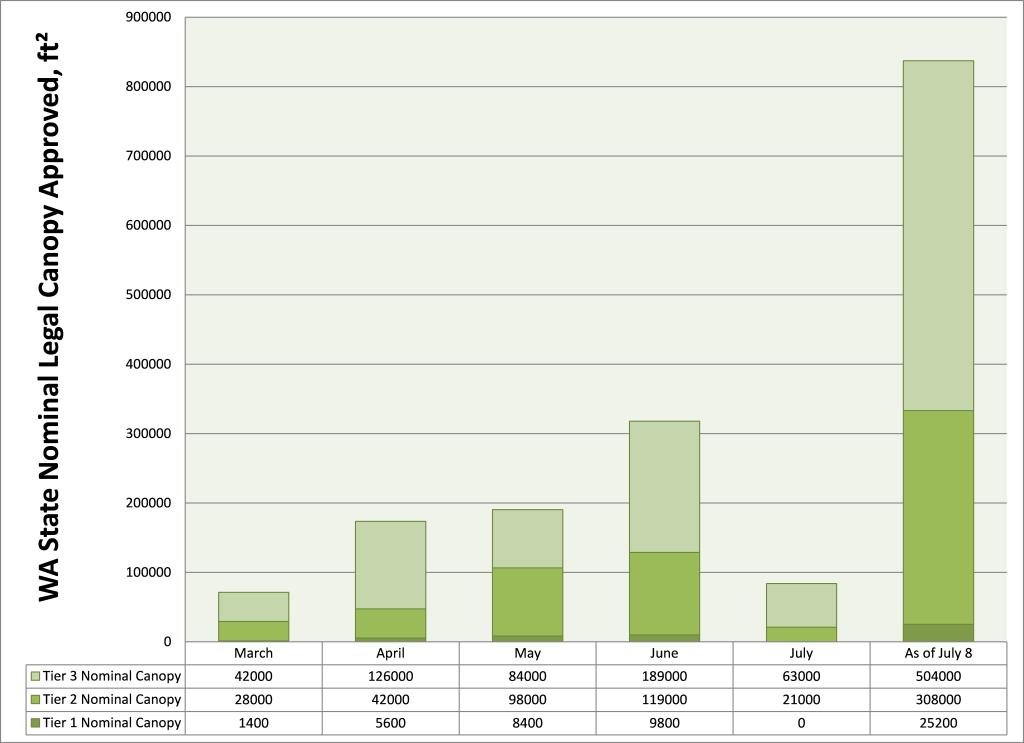

The above chart mirrors yesterday’s simple applicant-denominated narrative but is now broken into (a) Tiers per month and (b) nominal canopy approved per month. Quite simply, we sorted out the WSLCB’s June 8 data on 87 approved producers by Tier and multiplied by the maximum canopy licensed per Tier: 1400 square feet, 7000 square feet, and 21,000 square feet.

This allows us to mobilize some of the assumptions introduced yesterday in service of how much area can be cultivated rather than how many applicants can cultivate. Let’s review these, even though they will change with further data and in a different season.

1. We assume that all Tier 1 cultivation is indoor, and that most Tier 3 cultivation is outdoor since no Tier 3s have been approved in King County (where warehouse production as opposed to greenhouses is most likely) yet. Both of these assumptions are not likely to hold long, if at all, but they work as rules of thumb.

2. We assume that all finished production until October, with the exception of smaller light dep rotations, is indoor. No outdoor cannabis that is not light depped can be harvested until October.

3. We assume that producers could (have) put most of their garden into bloom upon approval, since they could have had their entire crop in vegetative stasis while they waited. How many of them were that prepared is an open question.

4. Therefore we assume that each approved indoor producer could have (had) product available between 6-9 weeks after being approved, given 5-7 weeks of bloom and one for (rushed) curing. This analysis indicates that while some June-licensed producers could be about ready to get product to market, all producers licensed before May 1 should be able to get product to market absent non-WSLCB factors (jurisdictional moratoria, municipal regulations, bad luck, incompetence, undercapitalization, etc). Because of our cutoff date, we really only expect 10 Tier 1s, 10 Tier 2s and 8 Tier 3s to be active since these were licensed before May 1 approximately 11 weeks ago. This allows us to expect the May cohort to approximately double supply by August 1, and the much bigger June cohort to quadruple legal cannabis supply by September 1.

5. We can also assume that all Tier 3 outdoor and greenhouse canopy is being light-depped to some degree, and therefore some small portion of their approved canopy will produce between in mid July and September. On the other hand, light-depped plants are smaller and yield less, and non-indoor producers really want to maximize their October harvest.

Tier analysis

168,000 square feet of Tier 3 canopy was licensed before May 1, our cutoff date for expected active canopy. This canopy can be used in a number of different and hybrid ways:s full-sun, greenhouse, hybrid greenhouse, light dep, and indoor. Tier 3 light dep canopy projections for mid-July to mid-August (light dep round 1) while 336,000 square feet were approved by July 8, which is a generous cutoff for a second light dep harvest mid-August-mid September. We will be able to track light dep numbers pretty soon and begin to get an idea of how much Tier 3 canopy was devoted to light-dep, which will allow us to project October harvest numbers. This is important because one of the first things people should know about non-indoor cannabis agriculture is that most of it is harvested in October, and therefore an increase in supply should lower wholesale prices per pound in November.

Until we have more information on the prevalence and practice of light-dep crops, though, we can’t guess at the ratio of light dep to full-term legal cannabis. Additionally, Tier 3 canopy licensed after a certain point is not going to have any full term harvest by the end of October and may utilize greenhouse hybridization to bring crops to harvest later and perhaps utilize fully convertible greenhouse design to convert to indoor production in the winter months. It will be interesting to see how quickly expertise, likely from Israeli cannabis consultants, maximizes year round greenhouse production. As hybrid greenhouse expertise is developed amongst Tier 3s, legal retail cannabis prices will become competitive with medical and illegal market prices. That’s a lot of uncertainty, which is why CASP projects a noticeable price drop for November 2014 and black market near-parity by November 2015, depending on how quickly the WSLCB expands its retail pool.

All the variables around Tier 3 production make it very hard to guess at what percentage of that 168,000 square feet of canopy is active, or even capable of maximizing light dep while successfully pulling off a full term harvest. Some Tier 3s are probably utilizing indoor infrastructure, as well, to get into the market before then. Tier 3 production will dominate market share when this stuff gets figured out, but it would be a real stretch to predict much impact before November.

So at the moment, it’s likely that active Tier 3s are using some percentage of their permitted canopy to grow indoor and light dep, which takes a bit longer than indoor but not as much as full term. Given this, we can make the extremely weak assumption that active Tier 3 producers are currently mobilizing a Tier 1 indoor cycle — both to accelerate time to harvest and to save space for full term outdoor. So the above chart isn’t much help, but basically 8 Tier 3s were licensed before May 1 so our first rough cut at maximum active Tier 3 canopy is 16,800 square feet at 1400 each.

Tier 2 production is a lot harder to get a handle on: it is likely to be mostly indoor west of the Cascades, and significantly non-indoor east of the Cascades. We will break down likely Tier 2 indoor/non-indoor splits by this geography later in this series, but for now we will mobilize the assumption that 80% of Tier 2 producers are indoor, and that Tier 2 producers who were licensed before May 1 should be capable of finishing product by now. So, 70,000 square feet of canopy were licensed to Tier 2 producers by May 1, and 80% of that is 56,000 maximum square feet of Tier 2 canopy.

Indoor Tier 1 production is on the same indoor schedule as Tier 2, and since we assume all Tier 1s are indoor we should have 14,000 square feet of maximum active canopy by now, from 10 Tier 1 producers approved by May 1.

Our extremely provisional calculations thus work out to a maximum of 86,800 square feet of active legal canopy that could have been harvested by now. That’s a far cry from the approximately 800,000 square feet of canopy figure being cited as approved in the news, and explains a bit better (a) why supply is so limited and (b) the rate at which it can be expected to increase.

How do these number translate into pounds, and can we refine our assumptions to learn more? Stay tuned for our next installment.

One thought to “Washington State Active Legal Cannabis Landscape Analysis: Part III”

Comments are closed.