Since the publication of this post, we have been alerted that our assumption that most active Tier 3 producers are not indoor may be way off. Blaine Stum, a researcher with the Spokane Marijuana Policy Working Group, reports that according to his research so far 7 out of the 8 Tier 3’s approved before May 1 may be indoor. We will adjust our analysis going forward, but keep this in mind for now — Dr. Corva, 7/19/2014

by Dominic Corva, Executive Director

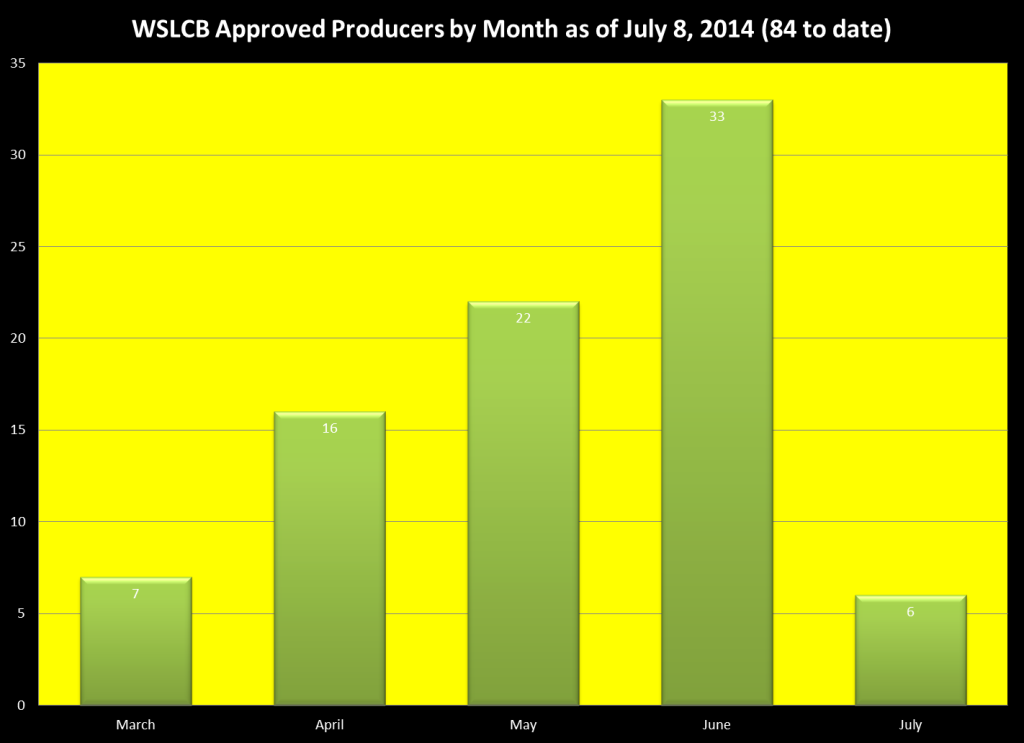

The Washington State Liquor Control Board released a July 8th update just a week after their last one. The purpose of this analysis is to inform policymakers and the public about the development of the active legal producer pool in Washington State, and it will be updated regularly.

Our first chart, above, tells us a little something about the pace of producer license approvals in Washington State. That pace is set by many variables, and it is not clear at this time which ones matter the most. Many assume that this rate is set by the LCB and therefore they are responsible for what is being termed the current “shortage” of legal cannabis in Washington State. We will address other variables in depth as this post is updated, but for now we can identify a few other variables: real estate markets and regulation are really important and maybe more so than the pace of the LCB; applicant incompetence is widespread; loss of capitalization as the process drags on; and bad luck should be included as a major variable.

The 84 active state producers counted in the simple chart above do not tell us, however, anything about how much canopy per month has been approved. CASP will be breaking this down in the coming days.

This chart does tell a simple story, though, from which we will extrapolate. Remember, indoor producers can grow from cut to flower in about 10 weeks (curing takes longer, but we will ignore that for now). Producers were allowed to start at any stage of the vegetative cycle, which is about a month indoor but can be indefinite. Producers who are on the ball have kept their clones in a vegetative state, and in an abstract ideal world the new producers have a significant chunk of their canopy on the cusp of flower when they are approved. Pending producers, take note and be prepared!

For the sake of our simple story, we will assume that no one activated later than Jun 1 is about to have product to market, since that’s about a month. In reality, plenty of earlier producers weren’t ready to flower when they were approved, and some producers in June were probably on the ball and about to sell product any day now.

That gives us about 44 active producers who should be capable of supplying the 24 approved retailers who have either opened up this week or soon thereafter. That’s not a nominal huge number, especially when we take into account that most of these are Tier 1s and Tier 2s. On the other hand, it means that over the next month the effectively active producers — ones able to process and package cured sinsemilla flowers — will double. How much a difference this makes will depend on how many more retailers open up; and how many of the 44 pre-Jun 1 producers will finally be coming on line like they should be given their head start.

And that’s really the issue right now. Approved producers aren’t necessarily active yet, in the final product sense, for all the other variables besides WSLCB approval. Many of them for some reason or another are missing out on the highest wholesale prices per pound we’ll ever see again. The first producer to be approved, Kouchlock, had exactly one pound — less, really, at 400 grams — to sell to Cannabis City yesterday. Nine Point out of Bremerton, WA, which was approved five days after Kouchlock, was able to supply Cannabis City with 10 pounds. Both undoubtedly have other outlets, but the contrast indicates that perhaps Kouchlock had been running into those other variables we mentioned above — and they affect approved producers, not just pending ones.