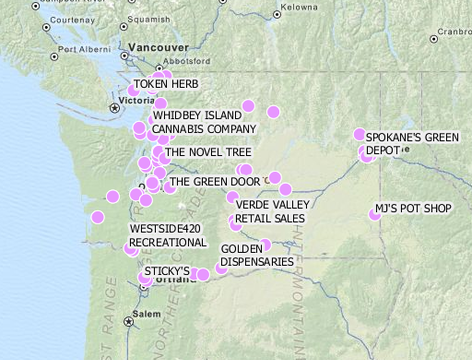

Map by Steve Hyde, CASP Geographic Information Specialist and Steven Wan, CASP GIS intern

by Dominic Corva, Executive Director

How accessible are legal cannabis retail stores relative to medical cannabis access points? This is a very important question for policymakers and the public. although we are about four months away from folks realizing just how much since the current deadline for medical access point transition is January 1.

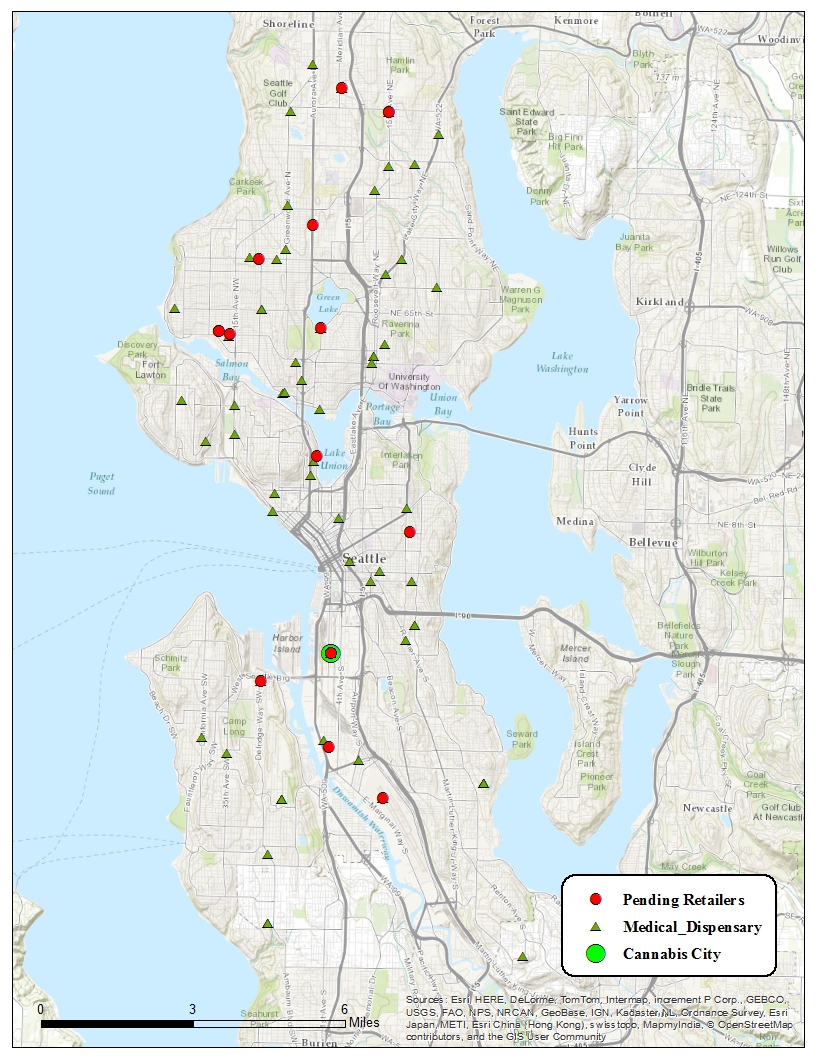

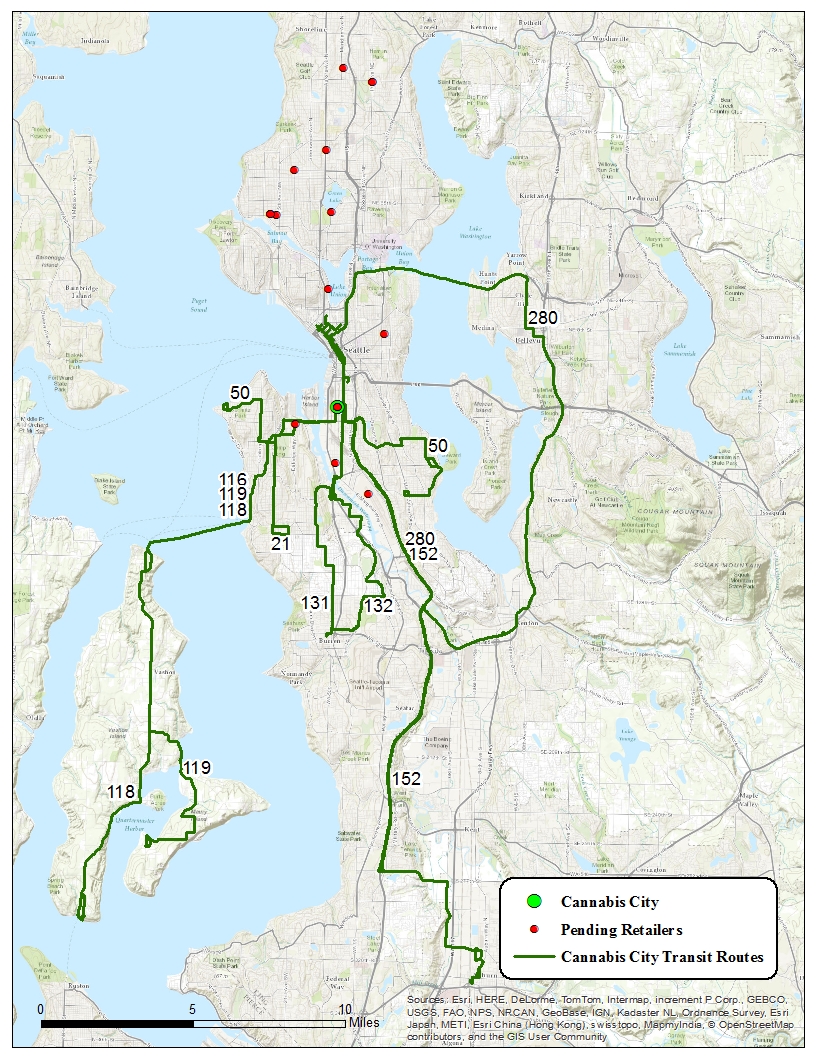

CASP located 96 medical access points listed by Weedmaps, accessed on May 15 by our intern Nathan Ogden. This is a lot less than the actual access point count which could be upwards of 300 in the Seattle area, but the ones that aren’t advertising are probably the first to go out of business — or don’t want to be listed. Twelve of these were listed as delivery service-only, and one of those (Winterlife) has recently made a judicious decision to “go medical” instead of advertising themselves as a legal delivery service.

We mapped these access points along with the 21 retail lottery winners from March so that we can begin to discern the relative accessibility access points vis a vis the legal retail landscape. We can now address the question through a preliminary analysis that addresses its significance to policymakers and the public.

In December 2013, as the legislative session approached, many policymakers claimed that I-502 retail stores would made medical access points unnecessary before a single retail store opened. These claims reflected the problematic discourse that patients (and the problematic category most politely referred to as “gamers of the system”) will have safe access through the legal system. Since the end of the short legislative session in February we haven’t see these claims in the media, but by January 1 such claims will undoubtedly pick up where they left off.

The map is quite clear and supports Pete Holmes’ public statements in support of more retail stores in Seattle proper, where according a recent RAND study about a third (see p 26 of the study) of the states legal consumption resides: medical cannabis access points are far more accessible than legal retail.

Legal Cannabis access, of course, matters beyond the question of whether it is acceptable in the near future to shut down all medical cannabis access points because Washingtonians can now visit the scattered smattering of legal retail locations most of which will experience supply problems in the next six months or so.

It also matters to legal cannabis consumers in Washington State. This is not the same as Washington State cannabis consumers. I cannot stress this enough: I-502’s goal to capture black market consumption is a LONG TERM goal, and anyone who considers I-502 to be failing right now because it doesn’t affect the black market needs this reality check badly.

Our working hypothesis is that until prices come down significantly, legal retail cannabis consumers will consist of tourists; existing cannabis consumers with discretionary income and an ideological commitment to supporting the new legal market; and new cannabis consumers whose main impediment to prior consumption has been its legality. This hypothesis was first stated by Dr. Corva over a year ago in the Aggarwal, Sexton, Corva and Mandel application for the Washington State cannabis consulting gig won by BOTEC, but more recently evidence has been presented to support it, by Jake Ellison in the Seattle Times Pot Blog.

So this next hypothesis is based on a long term interest by I-502-supporting public and policymakers in locating retail stores near potential customer bases, when the price comes down to the kind of parity that would start to capture existing cannabis users. The hypothesis is that existing medical cannabis access points are currently located in very specific places where (a) they won’t be driven out by NIMBYs; (b) the existing local social order finds cannabis retail acceptable and (c) property is cheap/landlords find their risk manageable. All of these conditions are also good ones for properly zoned potential legal cannabis retail locations.

A fourth condition is possible but insupportable with existing evidence: current medical access points are located close to cannabis users. The tendency for access points to cluster in low-income and industrial neighborhoods may reflect the lower income tendencies of daily cannabis users (again see the RAND report, which is a rich update of the research initiated by BOTEC last summer, and co-authored mostly by BOTEC veterans).

All users may find this map and others like it useful for thinking about where to locate retail cannabis stores in the future. We will be updating this analysis as more data comes in.