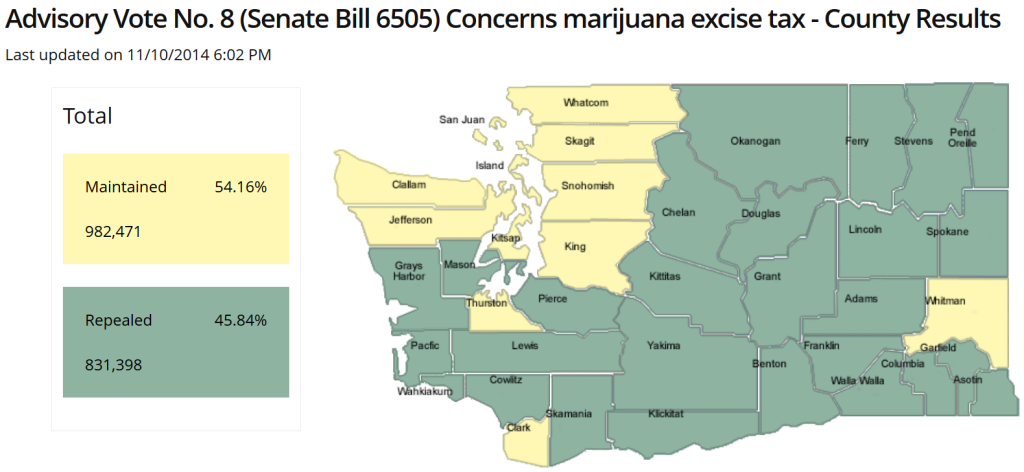

Map Source: http://results.vote.wa.gov/results/current/Advisory-Votes-Advisory-Vote-No-8-Senate-Bill-6505-Concerns-marijuana-excise-tax_ByCounty.html

By Dr. Jim MacRae, CASP Research Associate

Counties that chose, on Advisory Vote #8, the option to MAINTAIN the restrictions imposed by SB-6505 on common benefits and tax exemptions available to the remainder of Washington’s agricultural businesses tend to cluster in the Northwest portion of the State and are joined by Clark and Whitman Counties.

The negative correlation apparent in the following graph demonstrates that Counties voting for the legalization of recreational cannabis in 2012 have now expressed a preference to maintain the exclusion of common agricultural benefits and tax exemptions delineated in SB-6505.

MAINTAINING SB-6505 increases the production costs (and, in many cases, processor costs) of recreational cannabis. Given this, one might have reasonably expected to see less desire to maintain SB-6505 in areas that are on record as supporting the legalization of recreational cannabis. This is clearly not the case.

Perhaps this reflects enduring support for one of the original selling points behind I-502: the supply of new tax revenues to our State. Those favoring SB-6505 as one that eliminates tax exemptions to I-502 businesses may not wish to see the promised tax revenues they voted for in 2012 be compromised.

Conversely, those wishing to repeal SB-6505 as something that dramatically increases the cost of production of recreational cannabis (in a manner further compounded by the the multiple levels of subsequent excise tax) may well have realized that maintaining SB-6505 will increase both the cost of recreational cannabis to the consumer, and the difficulty of running a profitable I-502 business.

My interesting in the SB 6505 being maintained is that a marijuana business is not agriculture. Counties are allowing these business to go into rural residential areas. We have one starting a business next door to us. Our homeowners association by laws state that the land can only be used for residential, recreational and agriculture purposes only. With this bill being maintained, this would be one more item to pursue to stop this business going in next door. The government has not given any regard to homeowners and their investment in their home and property. They only think about the money that the marijuana business will bring in. These decisions were made behind closed doors. And when the homeowners found out what is happening and protest, the county make changes to the guidelines but grandfathers all applicants. So the changes won’t affect the business owners and really brings no satisfaction to the homeowners. These business belong in commercial zoning not rural residential or Inholding lands. The state and county government have ruined many homeowners investments, their retirement futures.

Barb: I appreciate your perspective – thank-you for sharing.

I had not considered people giving an advisory vote to maintain SB-6505 as an indirect attempt to further restrict where legal I-502 businesses can operate.

As an owner of Rural (NOT Rural Residential), Agricultural, and Forestry Lands, I put a good deal of thought into the flexibility of future uses allowed for such lands prior to purchasing them. Growing crops (whether for my and my family’s personal consumption, or for sale to others) has been an allowed use that I have always required before purchasing land.

Putting a cannabis seed into soil and then watering the soil and providing light, warmth, and nutrients, generally results in a baby cannabis plant springing forth.

Laws have the magical ability to change definitions. They can make a medically-effective (per a patent held by the Feds) drug appear on Schedule 1 as a controlled substance. They can, apparently, make water-boarding NOT torture. They can make sending missiles (without permission from the ally that holds sovereignty in the area) from an unmanned drone into a wedding party that some computer algorithm thought had too many adult males in close proximity to each other an acceptable practice. They can also, apparently, make us want to think that growing cannabis is NOT agriculture. We appear to disagree on this latter point, and I respect your position — but I fail to see how your concern that having an I-502 operation in your neighborhood might negatively impact the value of your home has anything to do with whether or not growing cannabis is, actually, growing a plant.

Food for thought …. having an I-502 business in your neighborhood might actually increase the value of your land and home (and, yes, I have seen data that support that this is exactly what is happening …. at least in Snohomish County).

Thanks again.

Jim