by Dominic Corva, Executive Director

This post compares what authorized medical cannabis patients have access to in medical cannabis access points, with what I 502 consumers have access to in legal retail stores. The purpose is to highlight what we talk about when we talk about “safe and reliable access” to cannabis products in the state. There are other aspects to this key policy question, especially price and location, but the former needs to be broken down by available cannabis products in order to make more sense than a simple flower price comparison. It’s also important to get a sense of where the I 502 market is going and what’s needed right now to get there.

The charts derive from sales data provided confidentially to CASP, and reflect a small sample size of both medical and legal retail cohorts (the latter is a MUCH bigger sample, comparatively, even though it’s from less information). The medical information comes from access points that pay sales taxes, as does the legal retail information of course. Both data sets include January 2015 data.

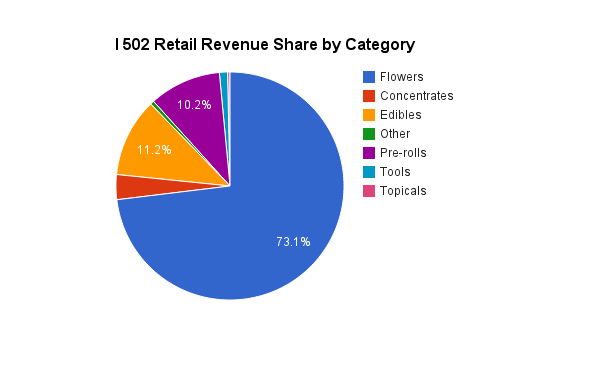

The first thing to note about the pies is their ingredients are not the same. Cannabis juice and shake/trim are not currently available in retail stores, although an argument could be made that shake/trim shows up in the “pre-rolls” category for both medical and retail. I also removed clone revenue from the medical pie because I am pretty sure there is no legal way for I 502 retail stores to carry clones. Juice and shake/trim, on the other hand, represent possible 502 commodities.

Let’s break down some other differences.

The legal revenue pie derives 17% more income from flowers than the medical revenue pie, 73% to 56%.

The legal revenue pie derives more than 10% from pre-rolls, whereas pre-rolls are a relatively insignificant source of revenue for medical. This probably, as noted above, reflects the arrival of shake/trim to market in the form of pre-rolls; and also the lack of processing capacity in the I 502 system to turn shake/trim into concentrates.

The medical revenue pie derives over 30% of its revenue from edibles and concentrates; where the retail revenue pie actually derives more income (11.2% to 8.3%) from edibles than the medical pie.

Legal concentrate share is running at about a fifth of the revenue share compared with medical.

“Other” is a weird but significant category for medical, and while I have not dug deep into the data it seems apparent that vape pens are the biggest “other” category.” It is therefore how I categorized legal vape pen sales, and that tiny red slice includes vape pens and pre-packed pipes.

The major take-away from this pie is that medical access points derive a much greater share of their income from a variety of commodities, especially higher value-added categories, than legal retail outlets. In order to draw consumption away from medical into legal markets, the processing capacity of I 502 has to develop substantially. There are many barriers to this, but it would appear as though edible processing is much further towards this than other value-added cannabis commodities.

One final note: the basket of goods sold in medical access points has been diversifying considerably in recent years, but two particular kinds of cannabis commodities should be considered “immature” for both medical and retail: juice and topicals. There is no reason to believe that these non-psychoactive health and wellness commodities, both of which can be made from hemp, will not constitute a huge growth opportunity for cannabis markets in general.

Oh, right, the reason I am even looking at this right now is the tax question. How can we project tax revenues for a legal market that not only has a long way to go to get to its presumed perfect substitute, the medical market, but also will be producing “nontraditional” cannabis commodities that are only now making a difference in more evolved markets? This comparison gets us somewhere to calculate per-gram potential tax revenue, which is a lot higher for value-added commodities than it is for flower.