Research by Danny Hackin and Dominic Corva

| Tradename | StreetAddress | City | County | DayPhone | Hours of Operation |

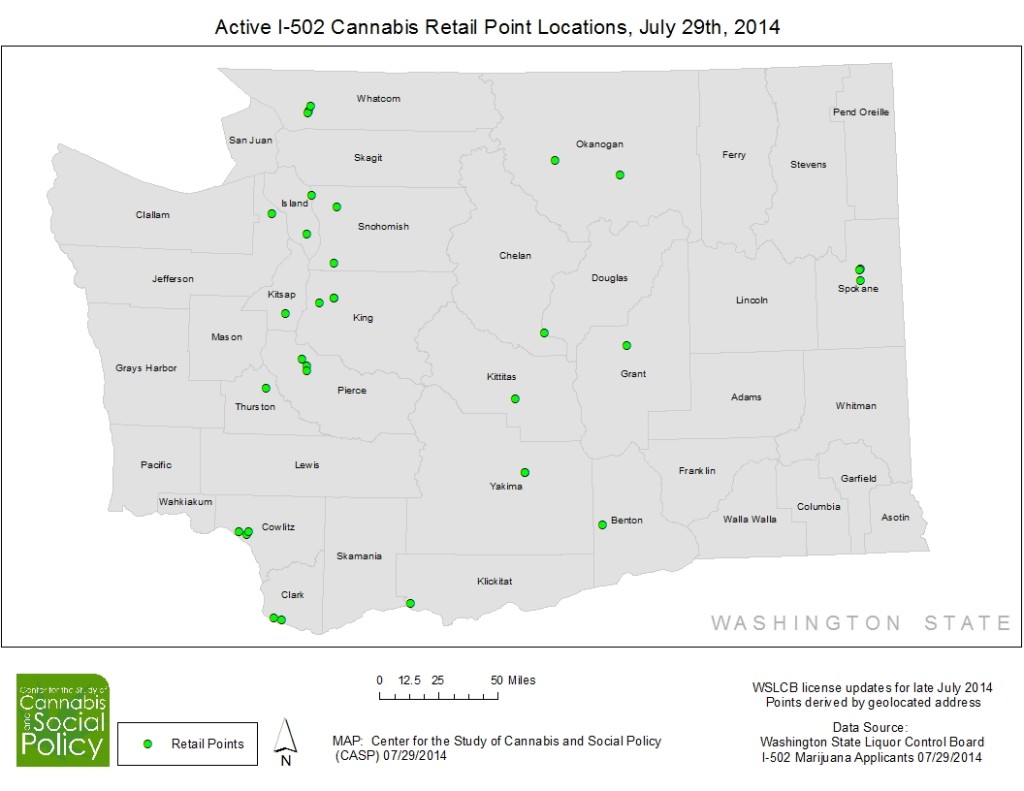

| 2020 SOLUTIONS | 2018 IRON ST STE A | BELLINGHAM | WHATCOM | 3603938697 | M-F 9-9, Sa 9-7, Su 11-6 |

| 420 CARPENTER | 422 CARPENTER RD STE 105 | LACEY | THURSTON | 3604026368 | Su-Sa 11-8 |

| 4US RETAIL | 23251 HWY 20 | OKANOGAN | OKANOGAN | 3602240978 | M-Sa 10-7 |

| ALTITUDE | 260 MERLOT DR | PROSSER | BENTON | 5097864200 | M-Th 2:30-6:30, F 1-8, Sa 11-7, Su 1-5 |

| AUSTIN LOTT | 29 HORIZON FLATS RD STE 8 | WINTHROP | OKANOGAN | 5094295556 | M-Su 10-6 |

| BUD HUT | 1123 E STATE ROUTE 532 | CAMANO ISLAND | ISLAND | 3606293480 | Su-Sa 10-10 |

| CANNABIS CITY | 2733 4TH AVE S 1st Floor Unit | SEATTLE | KING | 2066821332 | M-Su 12-8 |

| CASCADE KROPZ | 19129 SMOKEY POINT BLVD STE B | ARLINGTON | SNOHOMISH | 3606595422 | M-Sa 10-8 |

| CREATIVE RETAIL MANAGEMENT | 7046 PACIFIC AVE | TACOMA | PIERCE | 2536917293 | M-Su 10-10 |

| FREEDOM MARKET | 820A WESTSIDE HWY | KELSO | COWLITZ | 3603550682 | M-Su 9-12pm |

| GREEN STAR CANNABIS | 1403 N DIVISION ST STE A | SPOKANE | SPOKANE | 5099193398 | M-Th 10-10, F-Sat 10-12, Su 10-6 |

| GREEN THEORY | 10697 MAIN ST STE B | BELLEVUE | KING | 4255027033 | 9/1/2014 |

| MAIN STREET MARIJUANA | 2314 MAIN ST | VANCOUVER | CLARK | 4259745804 | M-Th 11-7, F-Sa 11-8, Su 11-6 |

| MARGIE’S POT SHOP | 405 E STUEBEN | BINGEN | KLICKITAT | 5094930441 | Su-Sa 10-7 |

| NEW VANSTERDAM | 6515 E MILL PLAIN BLVD | VANCOUVER | CLARK | 3605974739 | Su-Th 11-9, F-Sa 11-10 |

| SATORI | 9301 N DIVISION ST STE B-C | SPOKANE | SPOKANE | 5099947051 | Su-Th 11-7, F-Sa 11-9 |

| SPACE | 3111 S PINE ST | TACOMA | PIERCE | 2066508908 | M-Su 10-10 |

| SPOKANE GREEN LEAF | 9107 N COUNTRY HOMES BLVD STEB | SPOKANE | SPOKANE | 5099193467 | M-Sa 10-8:30, Su 10-7 |

| THE HAPPY CROP SHOPPE | 50 ROCK ISLAND RD | EAST WENATCHEE | DOUGLAS | 5098881597 | M-Th 12-7, F-Sa 12-8 |

| TOP SHELF CANNABIS | 3863 HANNEGAN RD | BELLINGHAM | WHATCOM | 3602243735 | M-Th 10-8, F-Sa 10-10 |

| VERDE VALLEY RETAIL SALES | 4007 MAIN ST | UNION GAP | YAKIMA | 5094203430 | M-Su 10-10 |

| WESTSIDE420 RECREATIONAL | 4503 OCEAN BEACH HWY STE 103 | LONGVIEW | COWLITZ | 3604235261 | Th-Su 10-8 |

| WHIDBEY ISLAND CANNABIS COMPANY | 5826 S KRAMER RD STE A AND D | LANGLEY | ISLAND | 3603216151 | M-Su 10-10 |

| GREENSIDE | 10600 MAIN ST | BELLEVUE | KING | 2069103811 | M-F 10-9, Sa-Su 10-7 |

| MILL CREEK NATURAL FOODS | 4315 MAIN ST STE A | UNION GAP | YAKIMA | 5098400186 | M-Sa 12-5 |

| HERBAL NATION | 19302 BOTHELL EVERETT HWY | BOTHELL | SNOHOMISH | 4254852535 | M-Th 10-10, F-Sa 10-12pm, Su 10-6 |

| SEA CHANGE CANNABIS | 282332 HIGHWAY 101 STE 2 | PORT TOWNSEND | JEFFERSON | 2064228328 | M-Su 10-8 |

| CROCKPOT | 1703 SE SEDGWICK RD STE 113 | PORT ORCHARD | KITSAP | 2533127280 | Tu-Su 9-9 |

| CASCADE HERB COMPANY | 1240 E MAPLE ST STE 103 | BELLINGHAM | WHATCOM | 9082856086 | M-Su 9-8 |

| 420 HOLIDAY | 2028 10TH AVE | LONGVIEW | COWLITZ | 5093030681 | 9/1/2014 |

| ELLENSBURG APOTHECARY | 1516 WEST UNIVERSITY WAY | ELLENSBURG | KITTITAS | 5098335556 | M-Sa 10-6 |

| GREEN COLLAR | 10422 PACIFIC AVE S STE B | TACOMA | PIERCE | 2532670675 | M-Su 10-10 |

| CLEAR CHOICE CANNABIS | 8001 S HOSMER ST | TACOMA | PIERCE | 2534445444 | M-Sa 10-7, Su 12-6 |

| GREEN STOP | 7466 MT BAKER HWY | MAPLE FALLS | WHATCOM | 3603937702 | Not Yet |

| HERBAL ACCESS RETAIL | 661 NESS’ CORNER RD | PORT HADLOCK | JEFFERSON | 3602977996 | Not Yet |

| 221 | 18729 FIR ISLAND RD STE C | MOUNT VERNON | SKAGIT | 3604454221 | M-Sa 10-8, Su 10-6 |

| GREEN LADY | 3044 PACIFIC AVE SE STE B | OLYMPIA | THURSTON | 5098697574 | M-Sa 10-8, Su 11-7 |

| MARIJUANA MART | 1405 YELM AVE E | YELM | THURSTON | 3604801912 | October |

| SAVAGE THC | 4428 WILLIAMS VALLEY RD STE A | CLAYTON | STEVENS | 5099992989 | Tu-Su 12-8 |

| GREEN LEAF | 4220 MERIDIAN ST STE 102 | BELLINGHAM | WHATCOM | 3603032860 | M-Su 9-9 |

| TOKEN HERB | 837 A CRESCENT BEACH RD | EASTSOUND | SAN JUAN | 3603766900 | Not Yet |

| HIGH SOCIETY | 1824 BROADWAY | EVERETT | SNOHOMISH | 2063071651 | 9/15/14 (Hopefully) |

| LOVING FARMS | 2615 OLD HIGHWAY 99 S | MOUNT VERNON | SKAGIT | 3605405168 | October |

| SMUGGLER BROTHERS | 1912 STATE ROUTE 20 | SEDRO WOOLLEY | SKAGIT | 3606473437 | Late September/Mid October |

| CANNARAIL STATION | 1448 BASIN ST NW SUITE A | EPHRATA | GRANT | 5097541047 | Su-Sa 10-10 |

| SPOKANE’S GREEN DEPOT | 71 N RALPH ST STE 102 | SPOKANE | SPOKANE | 2532417773 | Not Yet |

| CANNABLYSS | 2705 HARTFORD DR STE A | LAKE STEVENS | SNOHOMISH | 4253277529 | Not Yet |

| SATIVA SISTERS | 10525 E TRENT AVE STE 1 | SPOKANE | SPOKANE | 2086603909 | M-Su 12-9 |

| I-502 CANNABIS STORE | 3012 GS CENTER RD STE A | WENATCHEE | CHELAN | 2817260614 | Not Yet |

| THE GREEN SEED | 8420 ASPI BLVD STE 3 | MOSES LAKE | GRANT | 5098552271 | Not Yet |