Map by Steve Hyde

by Dominic Corva, Executive Director

*This late September update uses the 9/30 Washington State Liquor Control Board list of “Marijuana License Applicants,” available here.

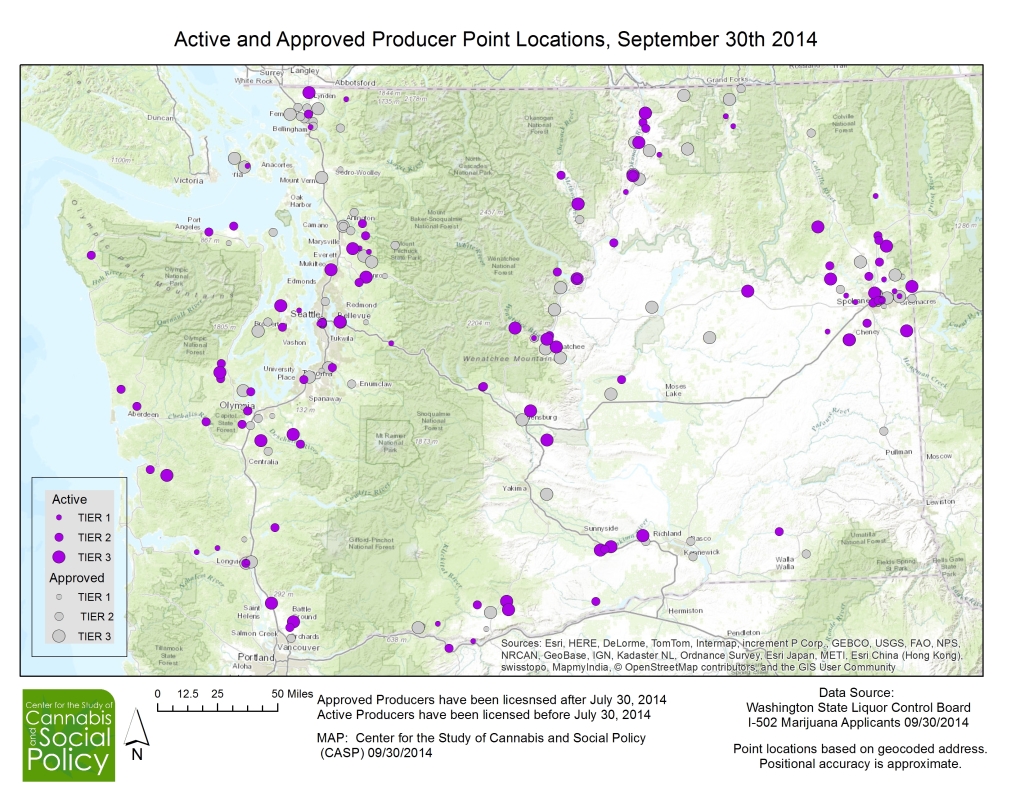

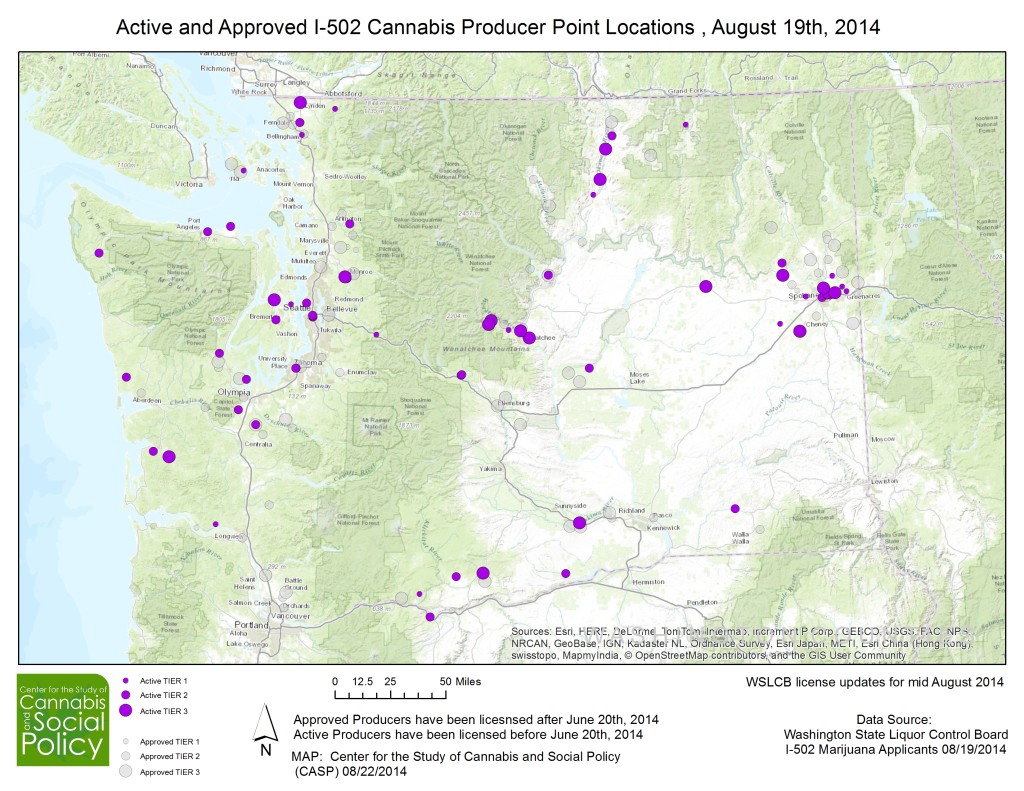

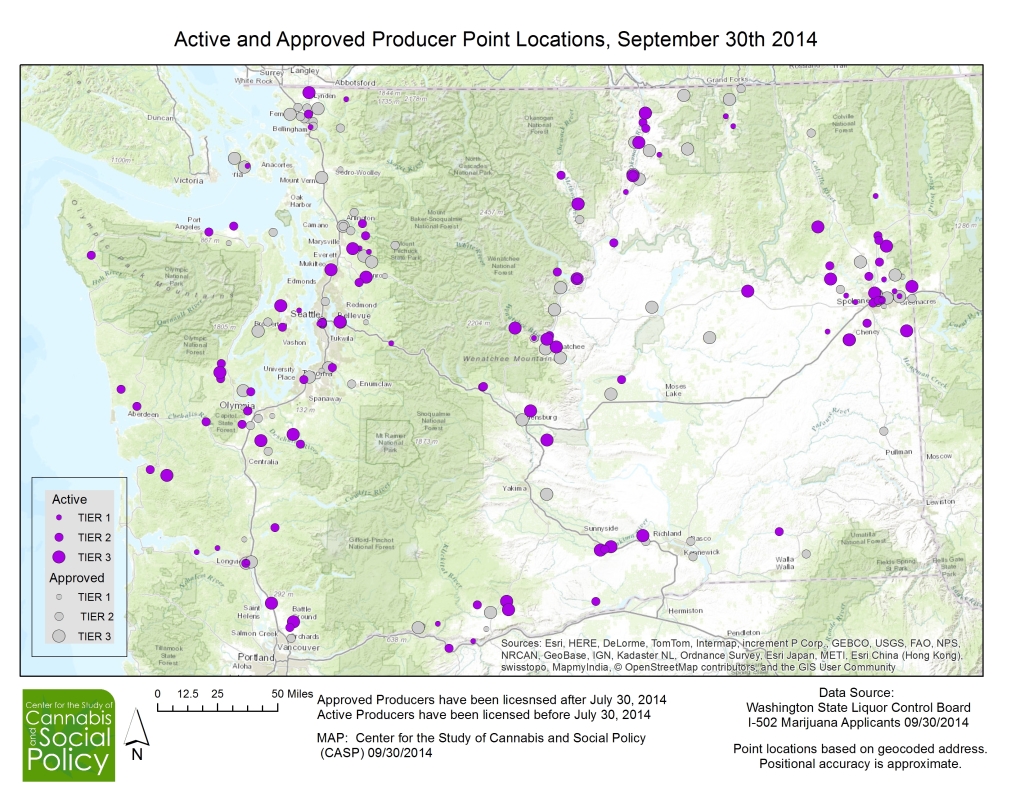

The purpose of this post is to extrapolate from the most current data in order to map the legal cannabis production landscape and identify the scope and rate of active production for the I-502 market. The map above shows you how the landscape is filling in by Tier, and differentiates “Active” from “Approved” producers by allowing for a 10 week lag between approval and approximate expected production. The 10 weeks are a “rule of thumb” estimation rather than derived from any particular assessment for each producer. All producers approved by July 21, 2014, are therefore considered active for this update. We’ll start with a table that shows our estimation of Active max square feet of canopy by Tier, next to pending production, approved less than 10 weeks ago, next to the total Approved. Given that the outdoor and greenhouse harvest season is upon us, we cannot with confidence project all currently approved producers as active in the next ten weeks, because many of them simply won’t be able to begin significant harvest cycles.

| Producer Tier |

Active 9/30 |

Approved not Active yet |

Total Approved |

| Tier 1 |

36400 |

30800 |

67200 |

| Tier 2 |

385000 |

315000 |

700000 |

| Tier 3 |

777000 |

1029000 |

1806000 |

| All Tiers |

1198400 |

1374800 |

2573200 |

The WSLCB has approved about 2.5 million sq feet of canopy, but only about 1.2 million sq ft of canopy should be considered “active” in the sense that they are producing harvests at regular intervals.

We have been inquiring into canopy usage over the last month, in order to refine our projections further. We found that outdoor producers were using about 95% of their max canopy, while indoor producers were using about 30% of their canopy for flowering. This reflects the fact that a lot of canopy must be dedicated to the propagation and vegetative cycles, but also that many producers are “bootstrapping” their resources on their way to maximized efficiency. We therefore have enough information for this update to refine our data so that it reflects not only “Active” canopy, but “Effective” canopy.” In order to do this, however, we needed to estimate the canopy breakdown by grow type — indoor, outdoor, and both; and estimate those by Tier.

The WSLCB provided us with a sample breakdown these three categories of grow types by Tier for 150 approved producers — not everyone on the list, but most. This is a robust enough sample to predict with confidence the ratio of indoor, outdoor, and “both” for the active producer data set, by multiplying the ratio of each grow type by total Tier canopy.

| WSLCB sample |

Indoor |

Outdoor |

Both |

Total |

| Tier 1 |

25 |

3 |

2 |

30 |

| Tier 2 |

45 |

12 |

19 |

76 |

| Tier 3 |

13 |

20 |

21 |

54 |

This sample gave us a percentage of Indoor, Outdoor, and Both for each Tier:

| WSLCB coefficients |

Indoor |

Outdoor |

Both |

| Tier 1 |

0.83 |

0.10 |

0.07 |

| Tier 2 |

0.59 |

0.16 |

0.25 |

| Tier 3 |

0.24 |

0.37 |

0.39 |

Then we multiply these coefficients to multiply by our 9/30 breakdown of active producers by tier to get nominal sq feet of canopy by grow type:

| Approved Nominal Canopy |

Indoor |

Outdoor |

Both |

| Tier 1 |

30333 |

3640 |

2427 |

| Tier 2 |

227961 |

60789 |

96250 |

| Tier 3 |

187056 |

287778 |

302167 |

Then we multiply each box by our assumptions about Effective canopy according to the average of what our interviewees told us about the percentage of their canopy they were actually using: 95% for outdoor, 30% for indoor; and we split the difference for “both” to give us 65%. This is a very crude methodology, in no small part because “Both” is vaguely defined while actual combination practices may vary substantially.

| Effective Canopy |

Indoor |

Outdoor |

Both |

| Tier 1 |

9100 |

3458 |

1517 |

| Tier 2 |

142475 |

57750 |

60156 |

| Tier 3 |

116910 |

179861 |

188854 |

| Total 9/30 |

268485 |

241069 |

250527 |

This methodology not only allows us to estimate effective canopy per Tier by Grow. It also gives us a new aggregate canopy estimation, different from both Approved and Active, of 760,081 sq ft.

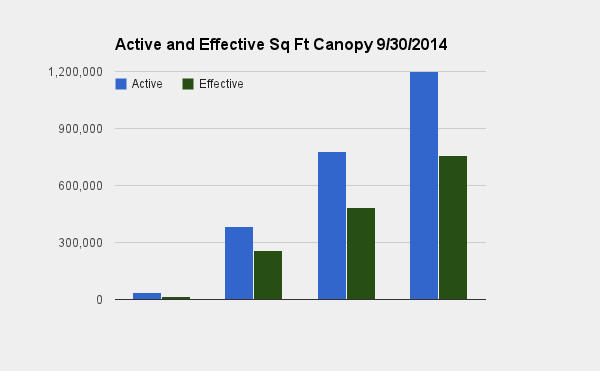

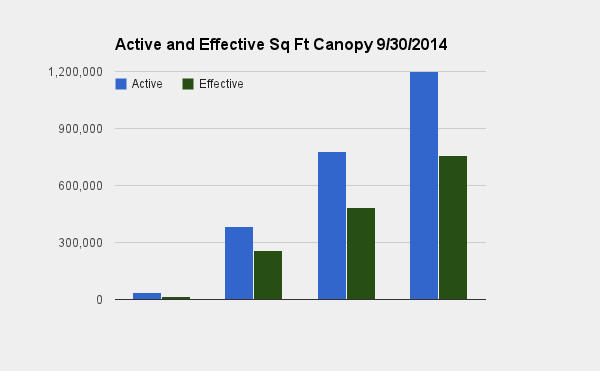

| Producer Tier |

Active |

Effective |

| Tier 1 |

36,400 |

14,075 |

| Tier 2 |

385,000 |

260,382 |

| Tier 3 |

777,000 |

485,625 |

| Total |

1,198,400 |

760,081 |

Effective Canopy is less than Active canopy, and this chart provides a way to compare.

We can also project what that canopy means in terms of lbs, using the WSLCB estimate of one lb of flower and one lb of trim per 25 sq ft. These numbers are nominal pending information from the WSLCB on percentage of crop failed microbial and other testing. My understanding is that this is a significant number,and we will update that when we hear back from the WSLCB.

| Current Cycle Yield |

Effective Canopy sq ft |

Lbs flower (nominal) |

Lbs Trim (nominal) |

| Indoor |

14,075 |

563 |

563 |

| Both |

260,382 |

10,415 |

10,415 |

| Outdoor |

485,625 |

19,425 |

19,425 |

| Total |

760,081 |

30,403 |

30,403 |

Concluding thoughts

1. The WSLCB is entertaining options for increasing canopy allotted to already approved processors. Speeding up the approval rate seems not to be an option, for pragmatic reasons. First, producer approval is no guarantee of producer viability: applicants have to deal with many other factors. One that has become clear recently is a trend in counties that are otherwise 502-friendly to zone out rural residential production. We have been hearing a lot about this from producers on the Olympic Peninsula, and it means that many folks who are approved suddenly don’t have county permission to proceed. We are also hearing about new moratoriums under consideration in for example Snohomish County, where NIMBYism seems to be activating resistance to individual 502 production. In all cases, approved 502 producers are rallying together to deal with common problems that simply can’t be dealt with at the state level and for which the WSLCB has no influence.

2. If canopy allotments change back to the original 2000/10000/30000 sq ft max, there is no need to panic if you have not been approved yet. There’s plenty more canopy that the state needs in order to overgrow informal cannabis markets. Many producers are not aware that the WSLCB consigned the original 2 million sq ft to the dustbin as a necessary originating fiction. A month ago, Randy Simmons opined that they have a vague ceiling range in their head now of around 8-10 million square feet, and other WSLCB officials have been quoted at 12 million sq ft. These numbers are fungible, and there are a TON of retail stores yet to open. Operating with about the same degree of confidence as Simmons seemed to be indicating from his seat next to me at an MJBA “Business Intelligence” panel, I wouldn’t be surprised to see approved canopy hit 20 million before it becomes a concern. Again: the strategy for getting legal prices down is to approve as much canopy as they can and overgrow informal cannabis markets.

3. Until this point I have focused on the trajectory of canopy approval as though it will increase incrementally, while the October harvest will bring prices down a bit. It’s time to put those two observations together. Outdoor growers will harvest in October, with product availability increasing in November. But if outdoor growers find it necessary to recapitalize by selling off inventory, that supply ease will be very short lived and we may resume an upward price trajectory through spring 2015.

4. As we gather data from active producers these estimations will be refined. Right now we don’t know how many cycles folks that were approved early have gone through; and how many cycles will dead-end in October. As it has been since the 1990s, indoor harvests will take us through the winter, spring, and early summer until light dep and hybrid greenhouses really get going. If you are a smaller producer, that will be a window to take advantage of until the Tier 3 outdoor price rudders turn. Don’t panic; get fair wholesale prices; and organize so you don’t get swallowed whole by increasingly industrial cannabis agriculture — which is going to have more financial shark money as we go along, not less.