Map by Steve Hyde

by Dominic Corva, Executive Director

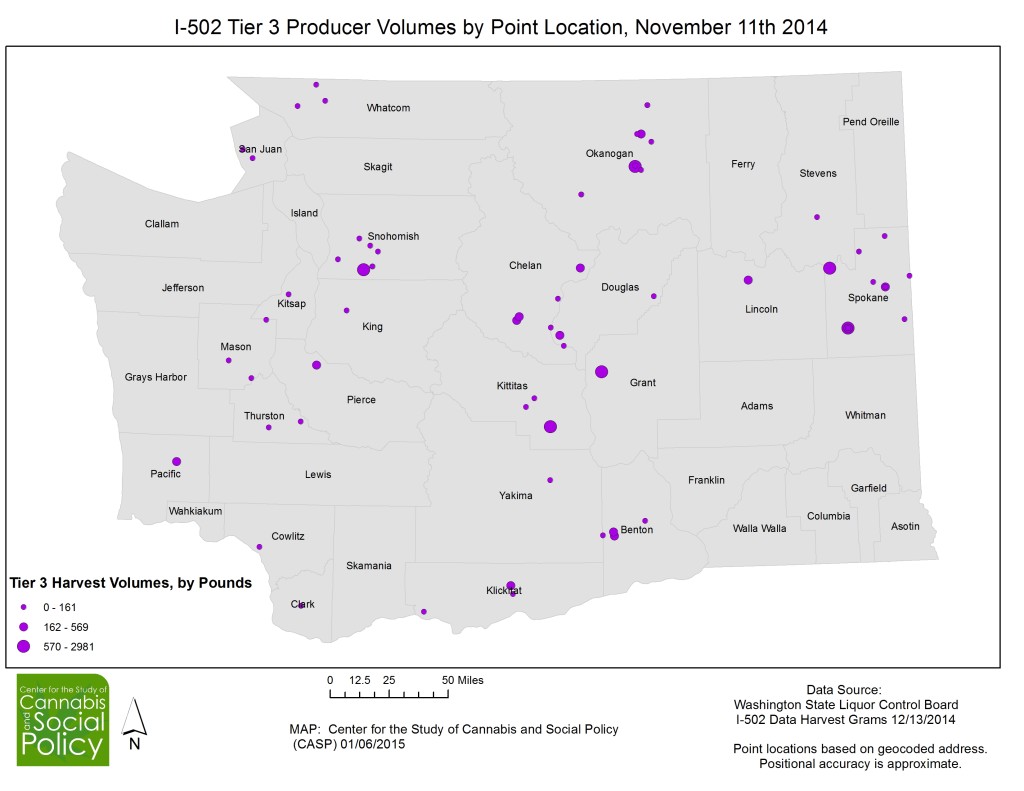

In the process of developing a forecasting methodology, I’ve noticed that “canopy” — maximum or effective — seems to be a very blunt tool for calculating harvest potential. However, it can give us comparative ratios that are much more credible than nominal numbers. Today’s post uses canopy to highlight a very significant factor for thinking about I 502 production in the coming year: the dormancy of most outdoor grows.

The 1/13/2015 WSLCB update counts 339 approved producer licensees. 78 are Tier 1, 153 are Tier 2, and 108 are Tier 3 producers. We applied our sample ratios provided by the WSLCB a few months ago to project how many of those are indoor, outdoor, and both.

| Tier 1: | Est. Licensees | Max Canopy | Effective Canopy | % of canopy |

| In | 65 | 91,000 | 27,300 | 1.33% |

| Out | 8 | 10,920 | 9,828 | 0.48% |

| Both | 5 | 7,280 | 4,732 | 0.23% |

| Tier 2: | ||||

| In | 91 | 634,145 | 190,243 | 9.27% |

| Out | 24 | 169,105 | 152,195 | 7.42% |

| Both | 38 | 267,750 | 174,038 | 8.48% |

| Tier 3: | ||||

| In | 26 | 546,000 | 163,800 | 7.98% |

| Out | 40 | 840,000 | 756,000 | 36.85% |

| Both | 42 | 882,000 | 573,300 | 27.95% |

| Total | 339 | 3,448,200 | 2,051,436 | 100.00% |

Simple math tells us that approximately 44.75% of currently approved production is classified as strictly outdoor, and therefore will not be harvesting for the next nine months. This number is the absolute low end of the percentage of approved producers that won’t be delivering product to market till Fall 2015: some unknown percentage of the 36.7% categorized as “both” indoor and outdoor are primarily outdoor.

If half that number are primarily outdoor — about 18% — then we would estimate that 63% of all currently approved I 502 canopy will not be yielding product for market until Fall 2015.

Of course, we don’t have good data on whether half that number is a good rule of thumb. I suspect it is too low. As we move towards a quarterly forecast, the takeaway point is that a LOT higher percentage of max canopy will be harvested in the fourth quarter, while about a third of max canopy could be harvested in the first three quarters. The third quarter will include Outdoor Light Dep crops, of course, and so we predict a steep production drop in the first quarter of 2015 followed by steady increase fortified by more producers coming on line.

That is really the difficult trend to anticipate. We don’t know how much of the current applicant pool is viable, on the one hand, and how many of those businesses will be sold to investors who can make them viable, on the other. As of now, the WSLCB seems content to let the market figure out how to distribute the limited number of licenses applied for in its first and only window.

An alternative would be to open up the process to merit-based applications, rather than let the production landscape go to the highest bidder. It is also possible the WSLCB will restore the 30% of max canopy it took away a year ago. We are at about 3.5 million out of 8.5 million square feet of max canopy the WSLCB has most recently estimated as the production ceiling.

In that case, though, investment groups may snatch up enough of the currently unviable applications to surge way past WSLCB intentions to cap production.

Astute readers will note that given the existing approved canopy numbers, Fall 2015 is likely to blow production up so much that many licensees will go out of business, on the one hand, and that I 502 retail will be extremely competitive with current medical access points. When I 502 producers start going out of business because wholesale prices can’t meet cost of production, indoor production will decline precipitously.

That goes for indoor gray and black market indoor producers, too — but does not apply to imported “indoor” from California, which is mostly outdoor. That price floor is probably about $1000/lb wholesale — and the legal system once up and running can beat it, if anti-competitive measures such as the tax structure are fixed.

The working hypothesis, then, is that those concerned with commercial medical production could easily wait it out — it won’t be long before market forces displace most of them. This hypothesis assumes that the 2015 legislature will (a) switch from excise to sales tax and only at point of retail; (b) resolve the local jurisdiction rebellion against I 502 participation; and (c) open up a LOT more retail stores.

You may want to rethink this…….dormant statement……..a true sun grown cultivator with prior knowledge and years of experience will out produce any indoor operation….PRODUCING THOUSANDS OF POUNDS in mere months………. not to mention smoke its competitors in costs and overhead …..and produce a product that is far superior than anything grown in a warehouse with supplemental lighting…..You cannot replicate the sun …..no matter how hard you try or how deep your pockets are. Cheers! TEAM GREEN

you might have missed this: “The third quarter [Summer] will include Outdoor Light Dep crops, of course, and so we predict a steep production drop in the first quarter of 2015 followed by steady increase fortified by more producers coming on line.”

honestly I’m not convinced 90% of 502 producers can get a full term crop right, and most of them have just heard about light dep in the last year if not on this post. One of the top 7 producers in the state is scrambling to upgrade their greenhouses to do just that, and I would suggest that’s a pretty good indicator that light dep is going to take a year to become a big part of the harvest.

Five years ago in Norcal, light dep was just catching on and now even the reallly old timers are doing it.

I’ve been looking for experienced sun grown light deppers in the crowd, and you my cannaverde friend are uncommon at the moment. You’ll do well!

Good update

Thanks for the great post Dominic. Say, do you know of any reliable indices or price aggregators? By some estimates, flower has seen a 65% drop, and oil has seen about a 50% drop (per gram) since October. Though, I’m hoping to find sources beyond anecdotes.

Prices are as opaque as the mylar side of 502 bud packaging, and the volatility comes with lack of information. We need a commodities exchange fix this, but in the mean time some fair-minded retailers are charging a fixed markup over wholesale, which prevents retail gouging. Also, we are beginning to be able to discriminate quality, meaning those prices charged just for being passed material just aren’t feasible.

You state that we’re approaching the 8M sq ft cap, but the table shows 3.4M sq ft. Can you explain the difference?

you are correct Brett, I think was originally basing that on projected approvals and that was what remained of that effort, for now. Thank you and I will correct it now.